Hi there,

In today’s post I will tell you how I discovered that Portugal is the ideal country for tax fraud.

I arrived in Portugal in September 2022 with a false idea that this country was a country of the European Union, but little by little I discovered how Portugal is a third world country in many aspects and even worse when we talk about taxes.

When I started to hire people to do works in the house, I was very surprised that the issuance of the invoice was not something that was done automatically and they did not even send it after asking for it.

Therefore, before hiring any service, I had to ask in advance if the person was willing to issue the invoice and most people would not even get back to me.

If they had to issue the invoice, people preferred not to work.

Little by little, I realized that tax evasion was reaching astronomical levels.

It was not only the construction worker who, when he received cash, simply did not declare his income. In fact, it was rare to find someone who had the decency to issue an invoice.

Workers, lawyers, notaries, real estate agencies, accountants, and it goes on and on.

The biggest shock for me was when in a consultation with a lawyer I asked if I could also ask to be paid as part of the pecuniary damages all the expenses I had in attorney’s fees. That man with a straight face told me no.

Why not? Because in order for me to be able to ask for the payment of his fees as part of my patrimonial damages, he had to issue an invoice for everything he charged me and, therefore, pay taxes for that money.

Understand how serious it is for a lawyer to lie to his client in order to continue evading taxes.

When I asked him about invoicing, he rambled on about whether we would see later if it was in our interest to pay VAT or not.

A surreal situation.

Obviously, in the end, I was left with the only lawyer who issued me the invoice without any problems.

My lawyer was telling me that it is very serious that a lawyer does not issue the invoices because when you go to a trial, the same court sends the information to the tax office to investigate whether the money collected has been properly invoiced.

In one of the many times that we went to the tax authority’s office to do some paperwork, I asked the official who attended us how it was possible that if people received the money by MBWAY (bank transfer), there was no one to investigate all that income.

In Spain, for example, if the person collects cash and nobody asks them for the invoice, it is likely that they will not issue the invoice since there is no trace of that money and they can risk evading taxes with a very low probability that they will be discovered.

In Portugal, even though they receive money daily by bank transfers and for very high amounts, there is no one interested in those hundreds of thousands of euros that people do not declare.

That is to say, even if there is a trace of the operations, the Portuguese tax agency does absolutely nothing.

The official who attended us told me that they only investigated if there was a complaint.

I started to report all the cases of tax fraud I knew about, most of the time with evidence, to see what would happen.

In the summer of 2024, we went to testify to the tax agency about the complaints we had made to Remax Rubeas, Nicolas Scavone and Paulo Correia for tax fraud.

We sent the evidence of the money that we had paid and for which not a single invoice had been issued. In addition, I told them that, if they checked the bank transactions, they would logically find an infinite amount of income that had no associated invoice.

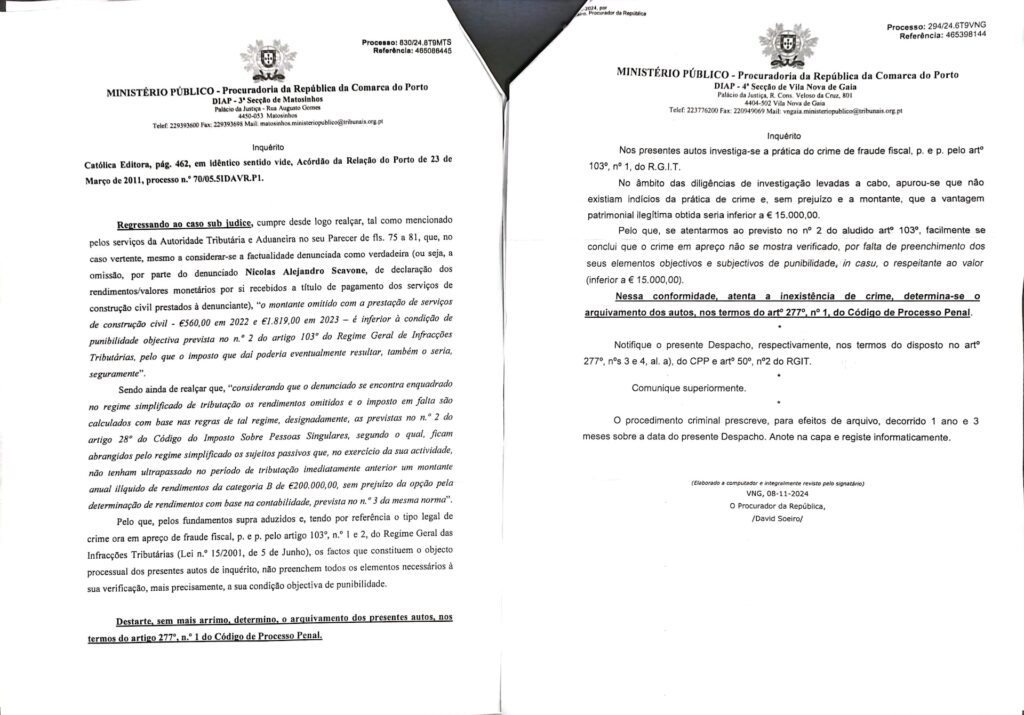

In November I received from the Public Prosecutor’s Office (DIAP) the respective responses to the complaints of Nicolas Scavone and Paulo Correia.

To my surprise, both complaints were filed because there was no crime.

Apparently, there is a law that says that it is not considered a crime of tax fraud if the amount is less than 15,000 euros.

Despite having asked to verify the accounts of these people since they would find multiple undeclared incomes, the people at the tax agency did not feel like working and since the amount I reported was less than 15,000 euros, they filed the process, which would prescribe in a year and 3 months.

That is to say, that each one of us who reside fiscally in Portugal, can evade the taxes corresponding to 15,000 euros.

One of the documents also refers to annual income of no more than 200,000 euros.

I do not even want to imagine what would have happened to these two people if we were in Spain or in a country like Switzerland or Luxembourg.

Portugal, in tax matters, must be the shame of Europe.

Some time ago I saw a TikTok in which a guy explained that in Portugal for the self-employed it was the opposite of Spain.

While in Spain they look at everything with a magnifying glass, they do audits, they fine you for the slightest delay; in Portugal you can do whatever you want.

I am not saying that Spain is fine, I simply want you to see the other extreme.

This may seem wonderful for all those who do not want to pay taxes, but then come the consequences.

The more relaxed the country is in the fiscal area, the more relaxed it will also be in other areas where it may be in your interest that things work well.

The more you can do whatever you want in the tax area, the more you are on your own. So, you will have to worry about your security by your own means as the judicial system, public health, education, social security, etc. may fail.

All those things that we are supposed to have guaranteed in “first world” countries, may not be so guaranteed if the tax collection is not done correctly.

In Portugal they are always on strike because they have deplorable salaries and conditions, the vast majority of people have private insurance because they do not feel they can count on public health, in addition with a co-payment that is very expensive, the processes take between 4 and 5 years to go to trial, the police never have the means when you call about a problem and most of the time no one appears ….

In short, nobody likes to pay taxes, and I understand that in countries like Spain a self-employed person does not issue an invoice for something that was paid in cash, but the situation in Portugal is exaggerated.

What I find most absurd is that not even the competent authorities do anything, not even when there is a complaint and evidence.

More articles about life in Portugal: