Hi there,

I told you in a previous post that in May 2023 we considered the options of buying land to put a prefabricated house or buying a new house.

We did not find any land that suited what we were looking for and we decided to start visiting houses to see if there was one that was better than what we already had.

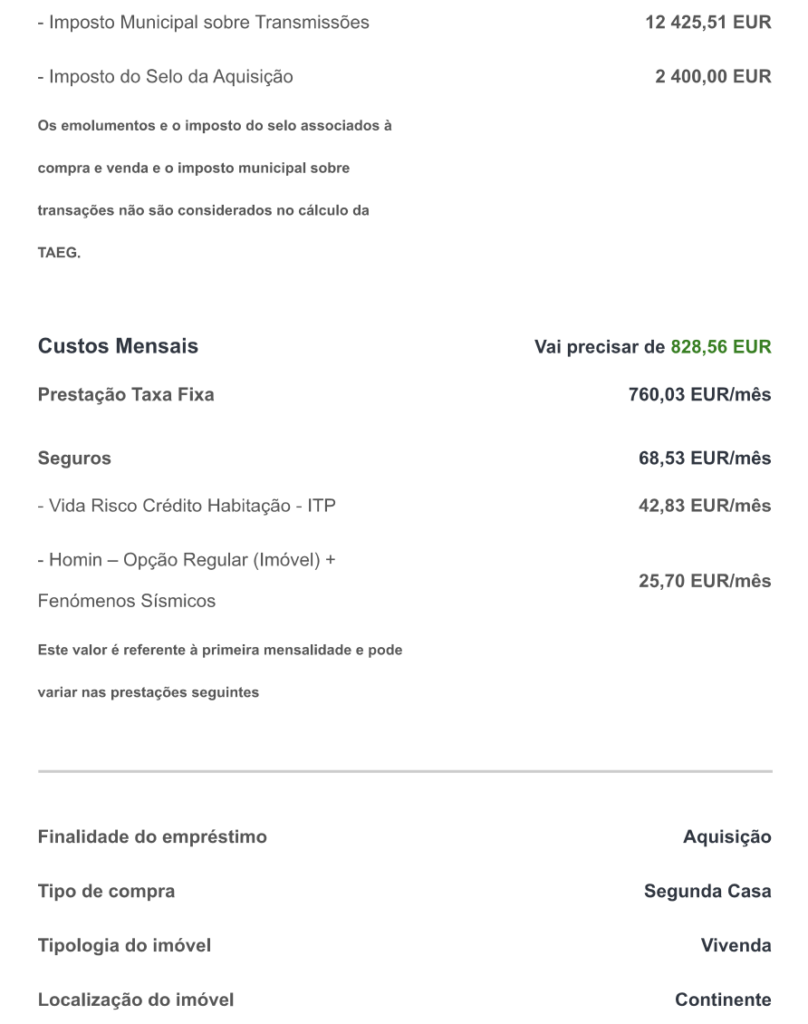

We set a total budget of 300,000 euros. That is, the total amount that we wanted to pay including taxes, fees, notary, etc.

Although we could afford to pay that amount without the need for a loan, we wanted to find out about the bank credit because perhaps it was convenient for us not to lose our capital since at that moment we did not know if we were finally going to have to pay for the legalization of the house and the lawyer.

My Zome Matosinhos agent sent me a link to apply for a bank loan evaluation.

In this link we sent our identity documents and the residence certificates of both; In addition, we sent the certificates of what we had in each of our accounts, where it was made clear that, if we wanted, we could pay for the house without a loan. We also sent the receipts for Diego’s last 3 salaries.

Then we received an email asking us for documentation for the second time.

They asked us where we lived, when that had already been placed on the form and we had also sent both certificates of residence.

They asked us if we owned the house where we lived and if it was fully paid for, the amount we wanted to invest in the next house, and they asked for Diego’s last 6 salary receipts.

Since I had already sent him the last 3, I sent him the remaining 3.

Then we had a meeting at the Zome offices with a UCI agent, who supposedly gave us the best option to request the loan.

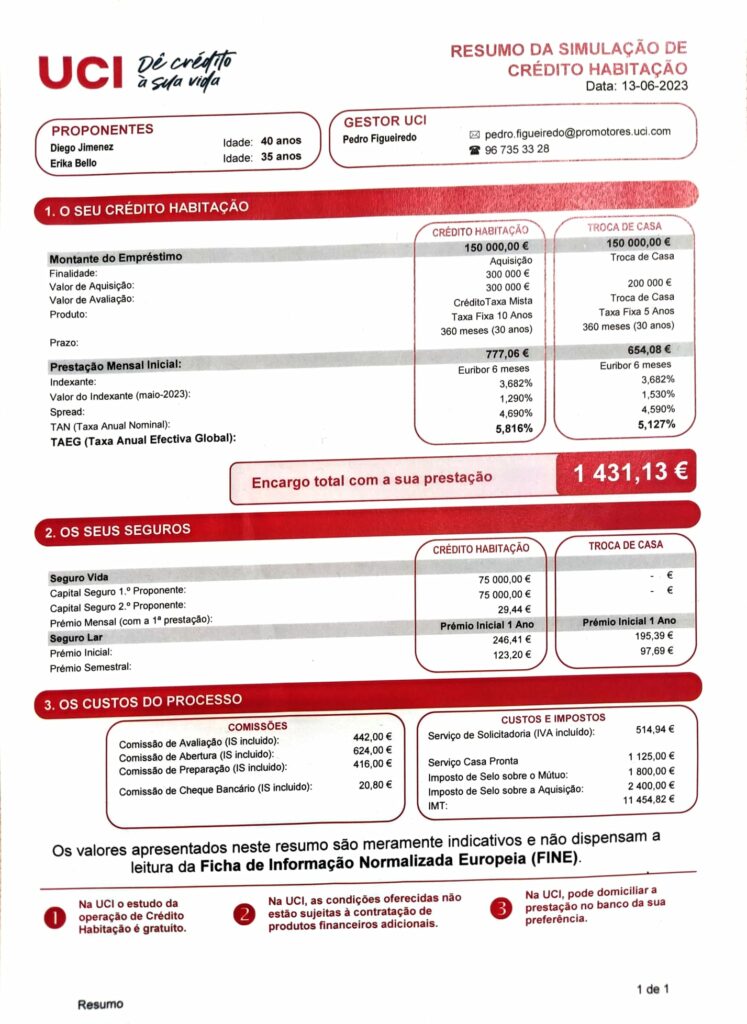

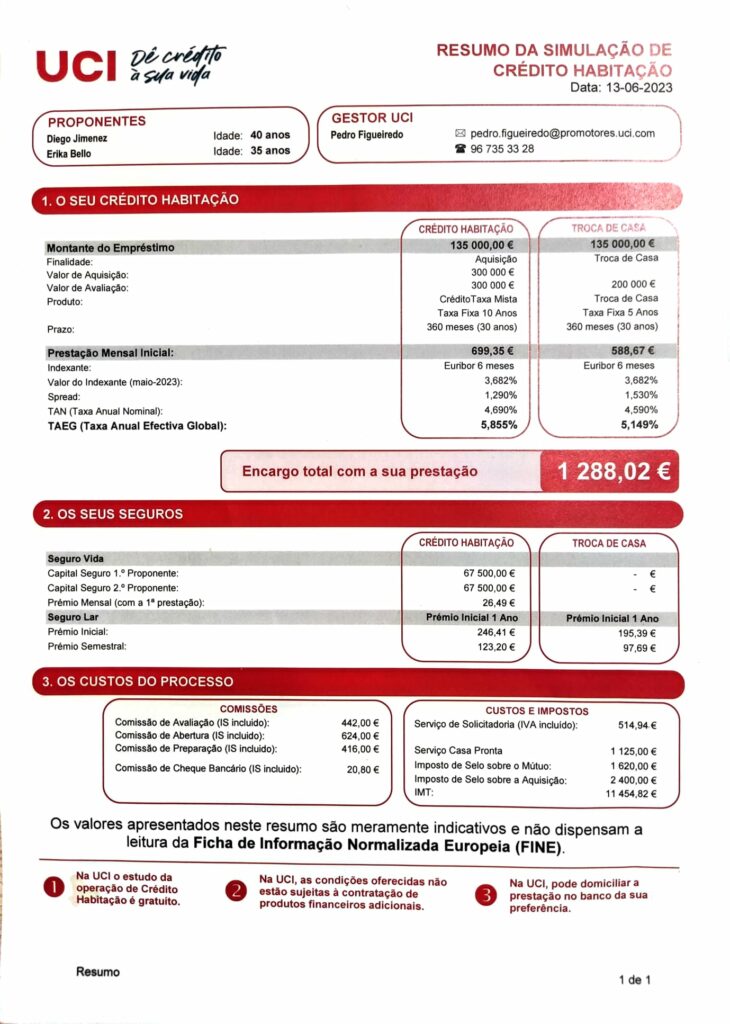

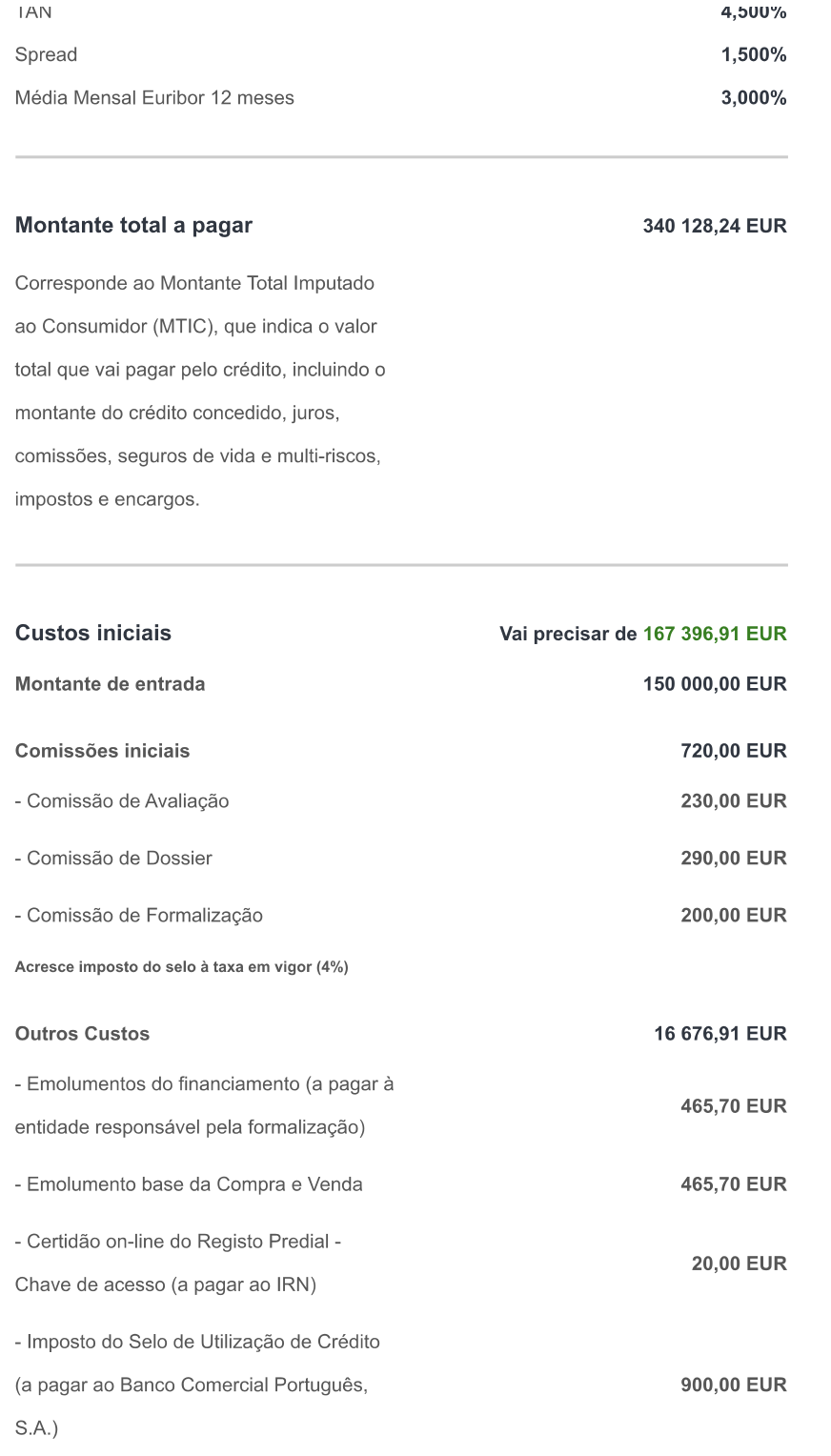

We were given these options:

Now in Portugal there is something called “Troca de Casa” which is a type of credit for those who want to change their home.

With this modality, the value of the house that you are going to sell has more advantageous loan conditions and as soon as you sell it, you can pay all the money without any penalty.

In our case, since only the part that is “legal” before the Municipal Chamber counts, the evaluation they made was approximately 150,000 euros.

Even if I sold my house for 280,000, the bank would only validate 150,000.

The remaining amount had the conditions of a normal bank loan and if you wanted to advance money, you had a penalty.

The fixed interest rate was almost 6%.

In addition, regarding the value that was backed by the sale of my house, during the first 5 years we only paid interest. Around 800 euros per month for 5 years, interest only.

Although UCI, unlike the banks, “did not charge you anything”, we had these things:

- Life insurance. It was not mandatory, but highly recommended because if something happened to us, whoever inherited the house would inherit it without debt. What we thought is that, if we died, it would matter very little to us who got the house and if they were going to have debts or not.

- Evaluation commission 442 euros. Price for them to tell you what value they give to both houses.

- Commission of opening 624 euros. Price for accepting credit.

- Commission of preparation 416 euros. Here I do not know what else they must prepare.

- Commission of bank check 20 euros.

- Notary service 515 euros.

- Ready house service 1125 euros. I specifically asked about this because I had no idea what it could be. It turns out that this is the price of the office where you will spend 20 minutes signing the purchase contract.

The rest were taxes paid to the state.

You see that even when they didn’t charge anything, they were charging a lot, and this without counting the interest that is already outrageous.

When I bought my apartment in Valencia, fortunately I didn’t have to ask for a bank loan because my dad gave me the money and I was unaware of all this procedure.

Diego had asked for a loan to buy his apartment and that’s when I understood why he was so reluctant to ask a bank for anything again.

With the papers in hand, I turned and asked him, is this normal?

Seriously, in my mind the interest for a bank loan was at most 2%.

Even so, since we had not yet found a house that we loved and that was worth the change, we were left with the bank loan as an option.

At that meeting, for the third time, they asked me for more documentation.

They asked again for my identity document, Diego’s last income statement, proof of the opening of independent activity before Finanças and a document issued by the Bank of Spain certifying that Diego has no debts.

We sent it all.

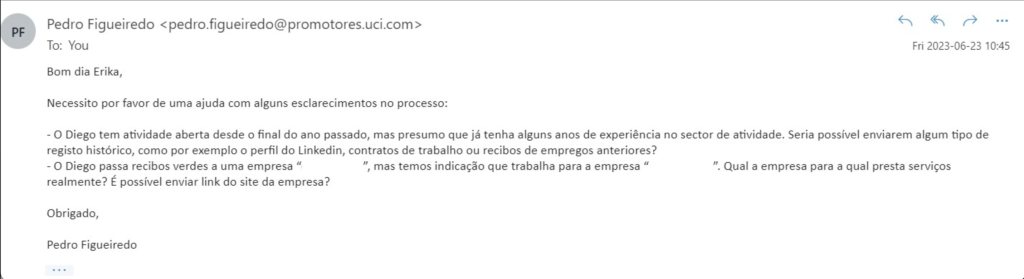

Then, for the 4th time, they asked for more information.

Now they were asking for LinkedIn profiles, clarifications about the company Diego worked for and the website, and “previous employment contracts.”

Here the issue was starting to bother me a lot.

Asking for websites and LinkedIn profiles seems stupid to me when he could have looked it up himself.

Also, asking for all previous employment contracts from a person who is 40 years old is crazy.

What they should have asked for was the work record, which is an official document.

Even so, I took the trouble to answer him.

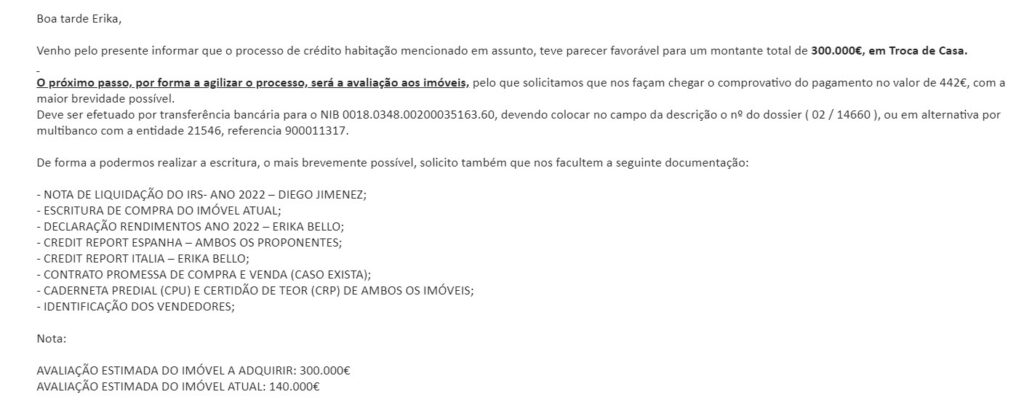

But again, for the fifth time, they wrote saying that the credit is supposedly approved and that they need a series of documents to be able to prepare the sales document.

They also said that we should immediately pay the 442 euros for the evaluation of both houses.

They ask again for Diego’s 2022 income statement, my 2022 income statement, the document from Spain for both of us that certifies that we have no debts (when Diego’s was already sent), and to complete, the document from Italy certifying that I have no debts in Italy.

If I had already told them that I had not lived in Italy, what do I have to do asking Italy for this document?

They also called my Zome agent to tell her that we could even ask for more money if we wanted.

Since we hadn’t seen any houses that we liked yet, I didn’t even bother to respond. I would manage this email as soon as necessary.

If you read my blog you already know more or less what I am like and that I hate wasting my time. I have no problem sending all the documentation they need, but what seems inadmissible to me is having to respond to an email every week since they are asking for things by the dropper.

Diego did a simulation at Activo Bank and the conditions were worse. In addition to the fact that the banks force you to contract a lot of services with them to accept the credit.

Even so, doing this procedure was useful to know how the issue of bank credit is currently.

We feel lucky to have some equity and not rely on a loan to get a home.

If I was already very connected to the entire housing crisis and the current situation of those looking to have a home, now I felt even more empathy.

With the prices of homes in Portugal, the salaries, and the requirements and payments that are implicit in a bank loan, I wondered who in Portugal today could buy a house.

More articles on buying a home and the real estate market in Portugal: