Hi there,

Here we go with another unfortunate story in Porto.

In Portugal, if your salary comes from a foreign company, you can have the status of Non-habitual Resident with which you do not pay taxes for that money for 10 years. Later we realized that this was a lie.

Here is more information on the subject:

https://gddc.ministeriopublico.pt/sites/default/files/documentos/instrumentos/rar39-1995.pdf

As of September 2022, Diego registered the independent activity and began issuing receipts monthly. This, with the help of Finanças (the tax authorities).

Every 3 months, two documents must be submitted: the VAT declaration and a recapitulative declaration.

The first time we forgot, and we got a letter saying we missed the deadline.

We called to ask them to help us make the statements and at the time of making the summary declaration it gave an error and could not be delivered. The person who was helping us on the phone told us to leave it that way and that it was not necessary to deliver it.

The time has come to file the income statement and since the tax authorities had worked well up to now (that is what we thought then), we decided to do it with the service they provide.

First, we made an appointment and went to one of the offices and it turned out that they couldn’t do it and we had to call since they had a telephone service specifically to help with the income statement.

We made the income statement and there were things that we had to look for on the Internet because not even the officials who attended us knew what to do.

Then we got a message saying that the tax return statement had been approved.

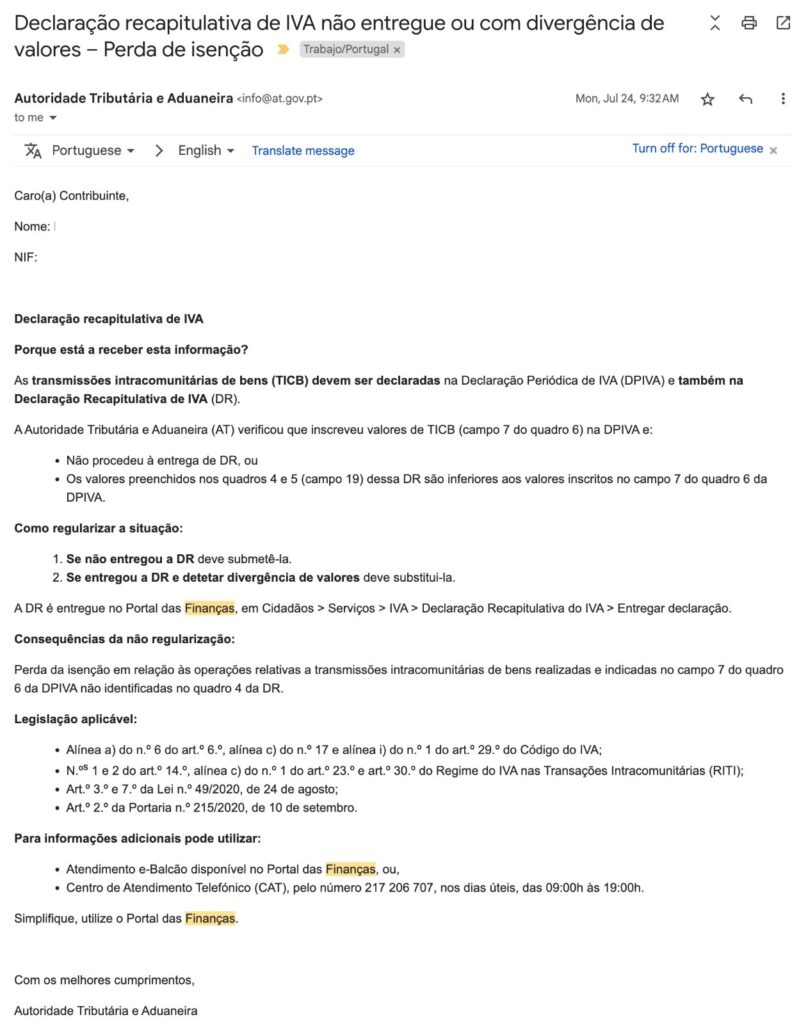

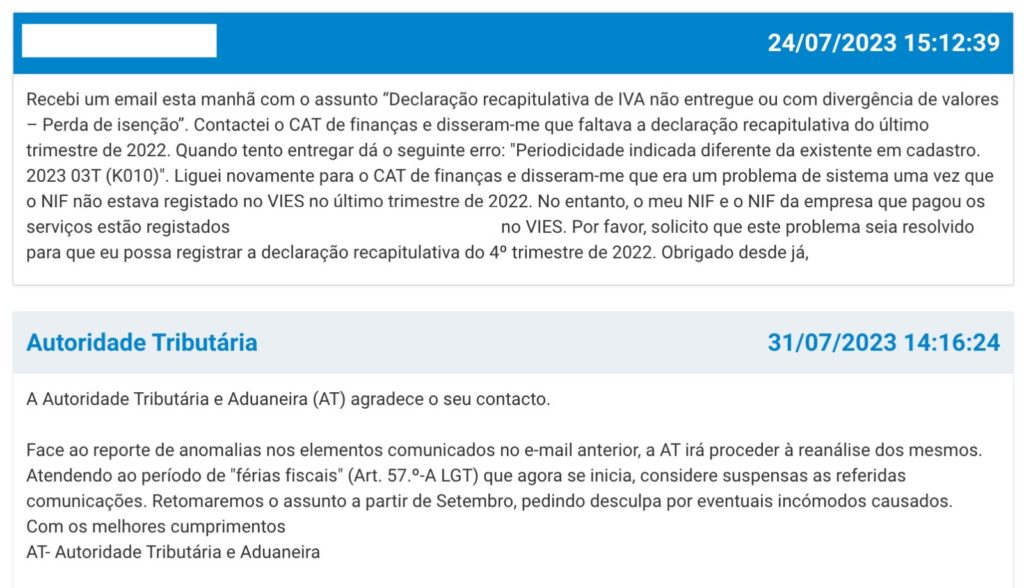

In July an email arrived stating that there was a problem with Diego’s independent activity and that we had to solve it, or he would lose his NHR status.

We immediately called Finanças and it turned out that the recapitulative statement that gave us an error did have to be delivered; we had been misguided.

We tried to do it on the phone, and it kept giving the same error. They told us that we had to send a message through the e-balcão because the problem was that the company’s vat number was not registered in VIES for the period of the recapitulative declaration and it had to be registered manually so that Diego could deliver the recapitulative declaration.

After sending the message, we received another email saying that they were going on vacation and that the matter would be taken up again in September; that we consider the first email as “merely informative”.

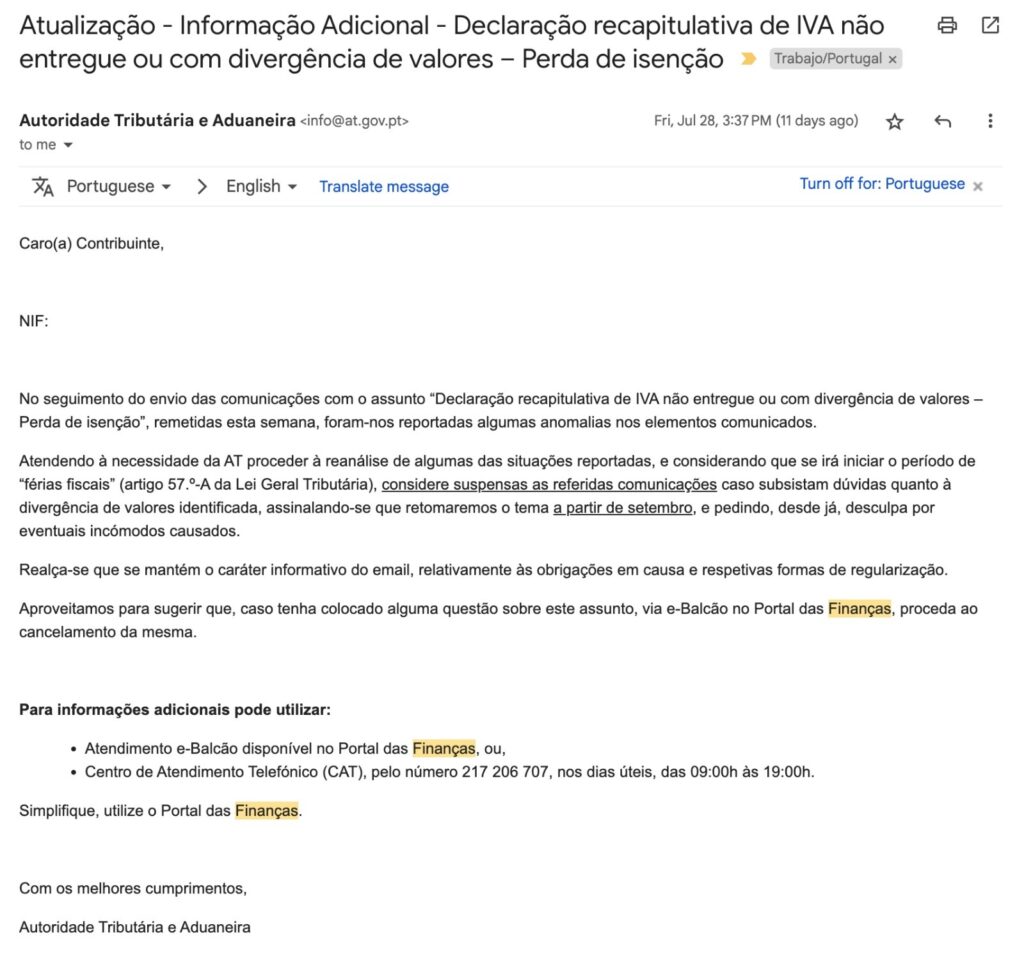

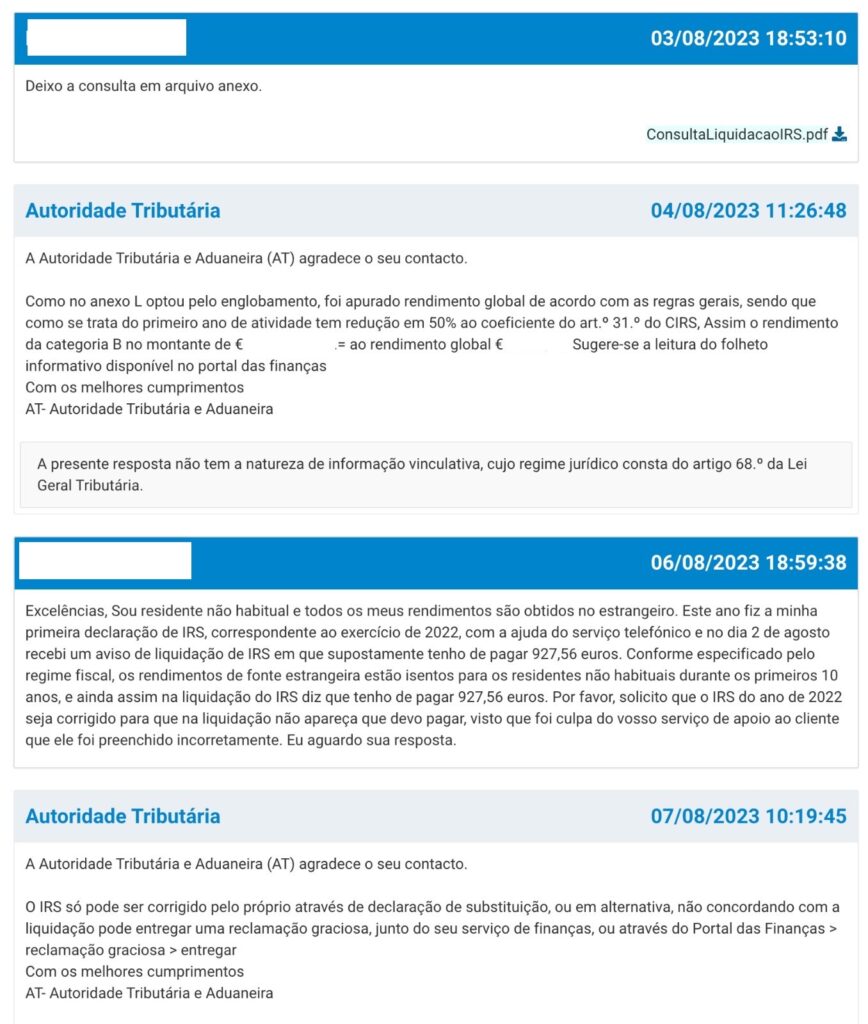

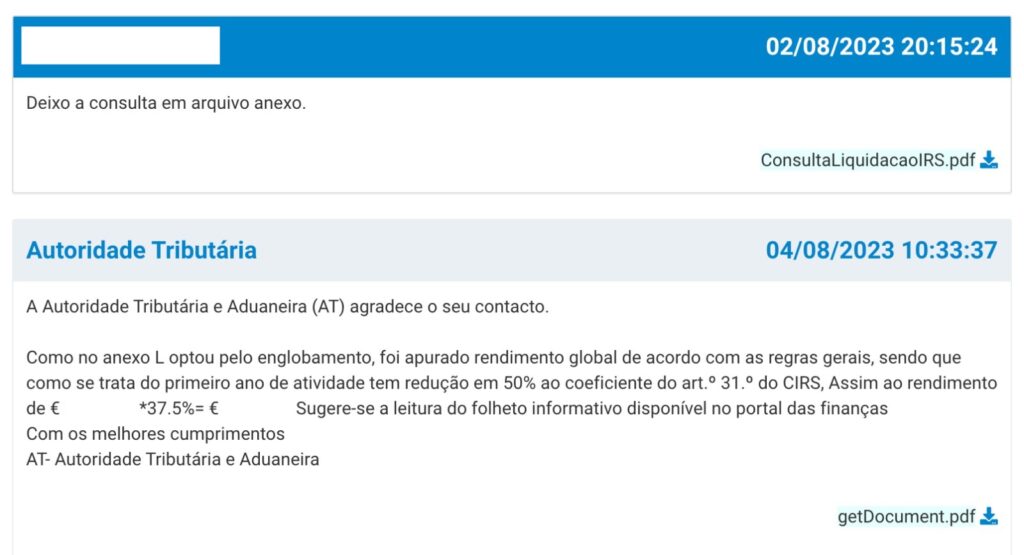

A week later Diego receives a notification telling him that according to his tax statement he must pay 927 euros.

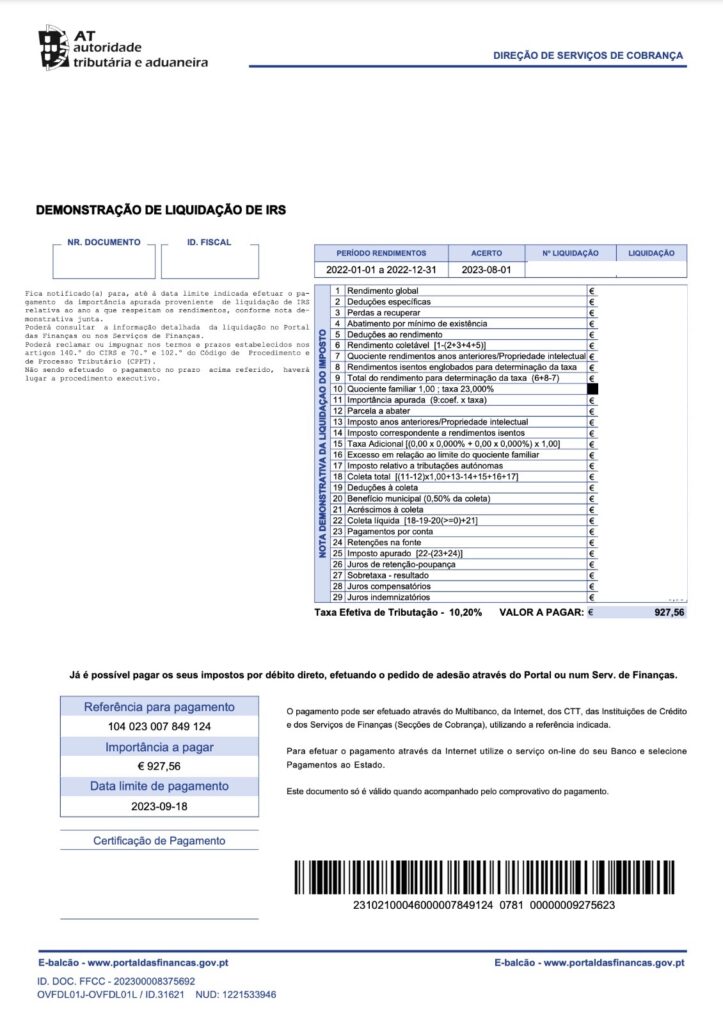

Again, we began to send messages and file claims through the Finanças portal because they had been the ones who had given us bad advice when making the income statement.

Every day I sent a message and made a claim.

The funny thing is that each time they answered something different.

We also placed the claim on the Portal Queixa and the response was to continue writing through the Finanças website.

We looked for an accountant to fix the mess that Finanças had created and the first thing he explained to us was that if you reside in Portugal, you must pay IRS regardless of whether you have the status of Non-Habitual Resident; and secondly, that the tax return statement was wrong.

We paid almost 70 euros for him to help us, but making the correction of the tax return statement was going to mean a fine thanks to the incompetence of Finanças. As the amount to be paid was going to be the same, we decided to leave it at that and make a contentious administrative claim.

In a future post I will tell you how this story continues.

Part 2 of this story:

More articles about life in Portugal: