Here I show you the reason why everyone evades taxes and swindles others.

In the previous post we got to the point where we had to pay almost 70 euros to an accountant to fix the mess they made us do in the tax return statement thanks to their incompetence.

We made a claim and paid the corresponding almost one thousand euros.

On March 23rd, 2023, we received a letter from Finanças saying that the deadline to make the recapitulative declaration had passed.

As I told you in the previous post we called immediately and with the assistance of the staff of finanças we did it and when we tried to deliver it, the system gave an error.

The incompetent person who attended us told us that “as the system was giving error, it was no longer necessary to submit it”.

We asked her several times to assure us that we were not going to have any problem.

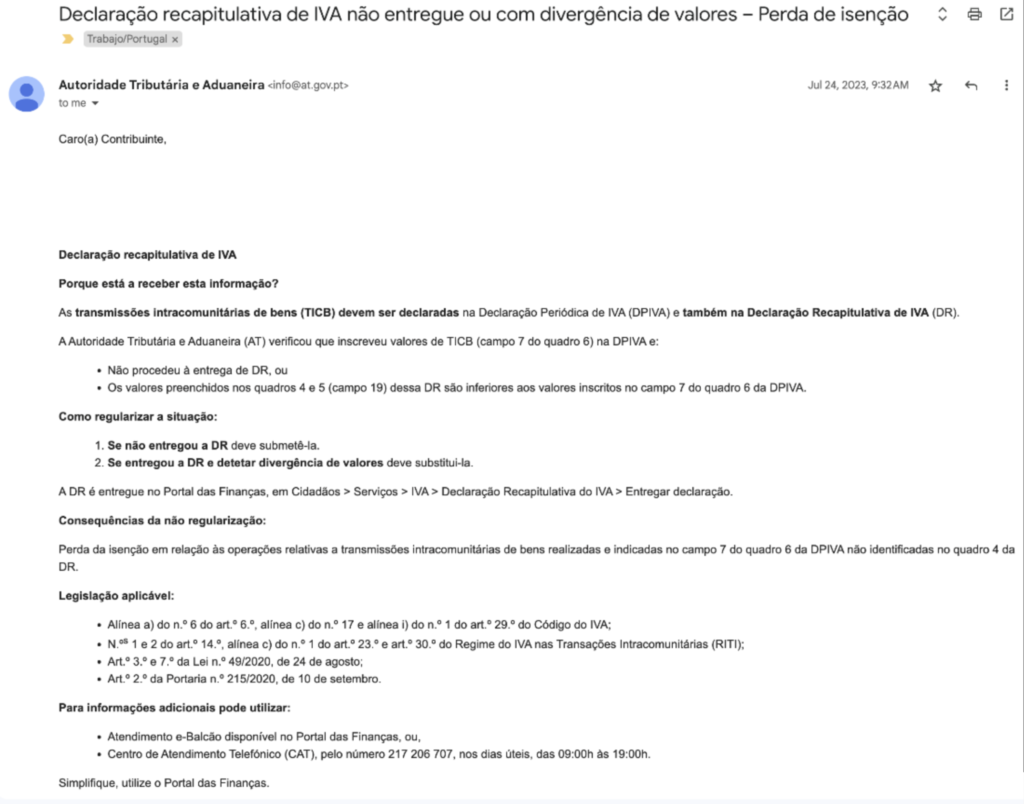

On July 24, 2023, Diego received an email in which they threatened to take away the benefits of the Non-Habitual Resident status for “divergence of values”.

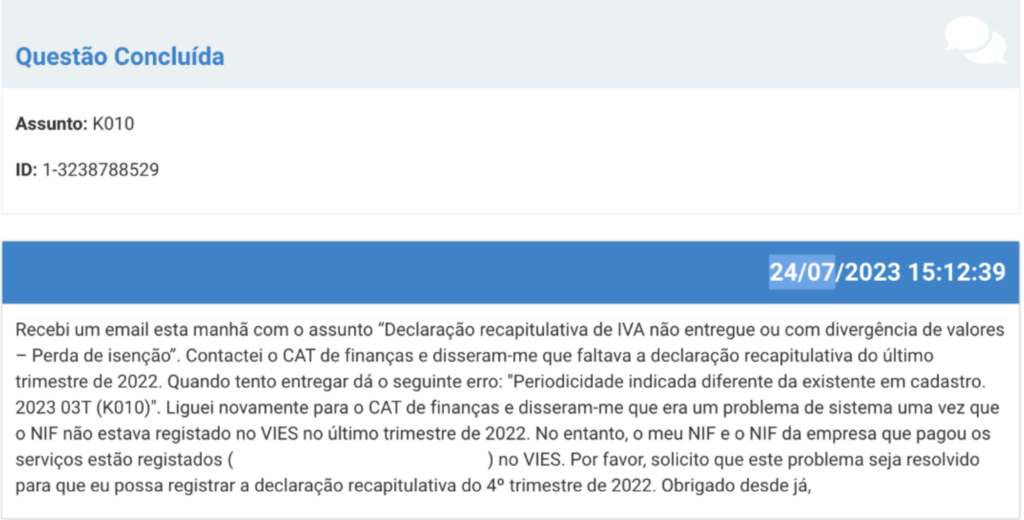

We called Finanças again and they tell us that it is because of the recapitulative statement that they had told us in March that it was no longer necessary to submit. We tried to submit it again with the telephone assistance and again we got the same error.

They put us on hold for an hour because the person who was assisting us had no idea what was going on.

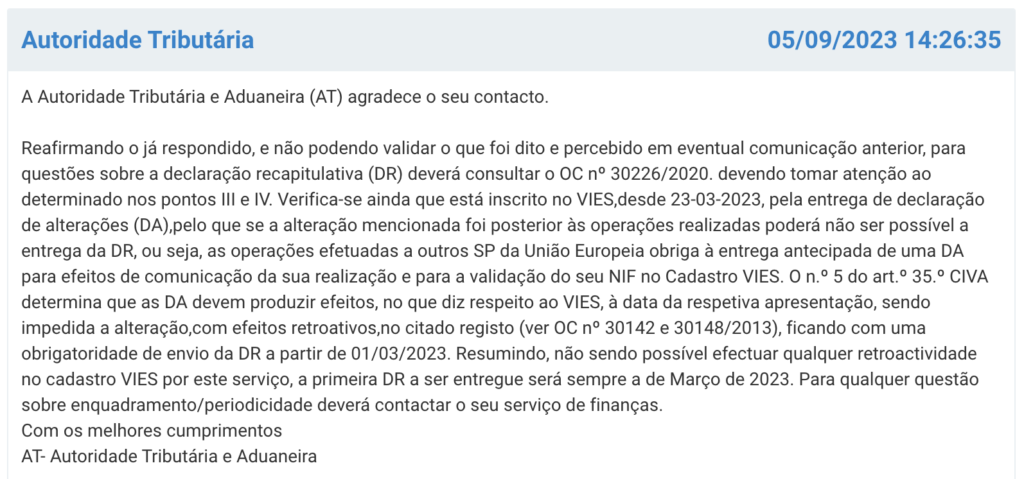

She tells us that the problem is that Diego’s activity is not registered in the VIES for the first quarter and we had to write through the e-balcão so that the corresponding department could register it and notify us so that we could submit the recapitulative statement.

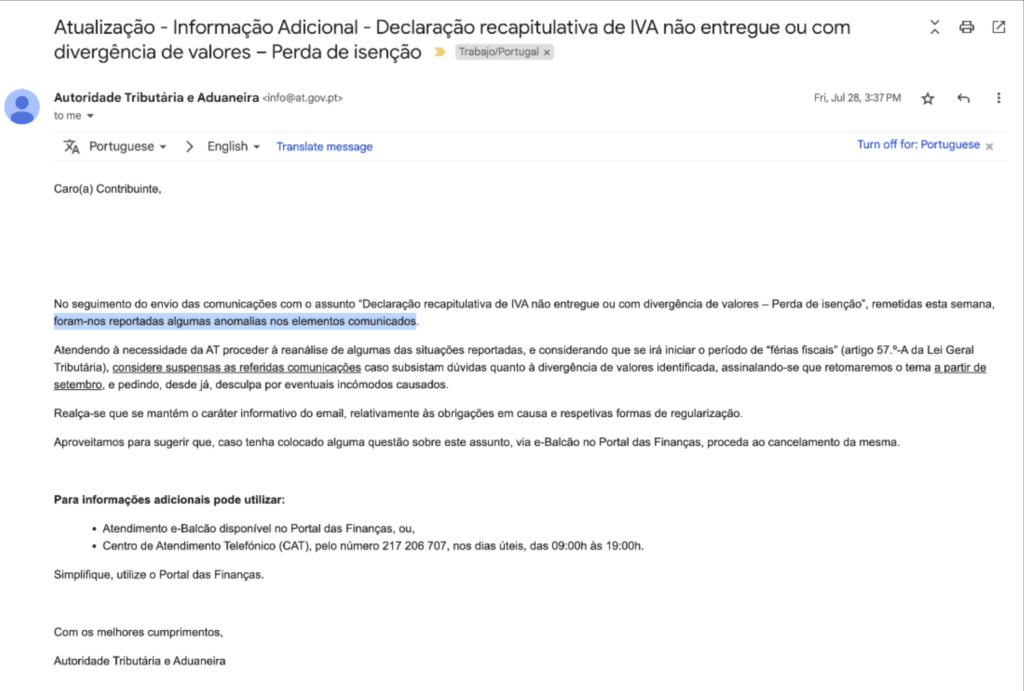

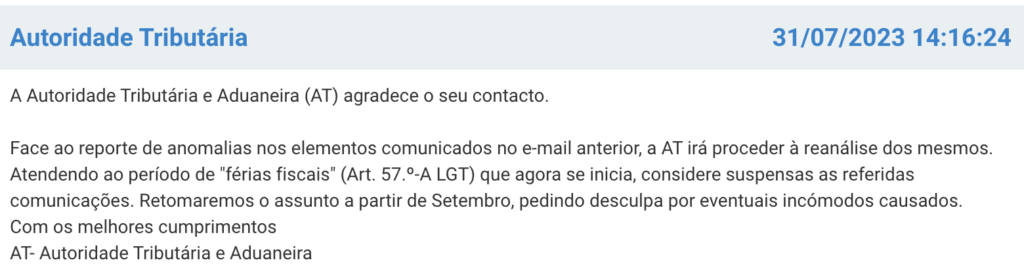

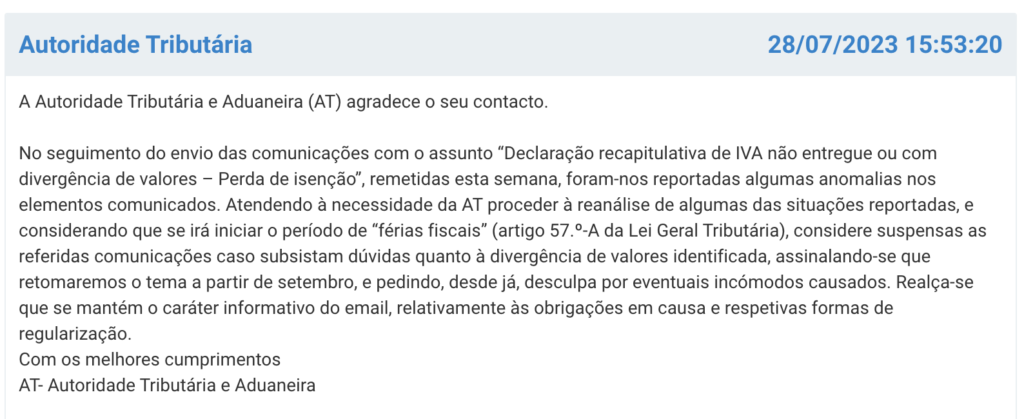

We sent the message and almost immediately two emails arrived; one with the same information as the first one, but with the period to which it referred, and the other saying that they were going on vacation and that they would resume the matter in September.

Knowing how things work in Porto, I told Diego to keep writing daily to get the problem solved. Every day there was a different response to the same message.

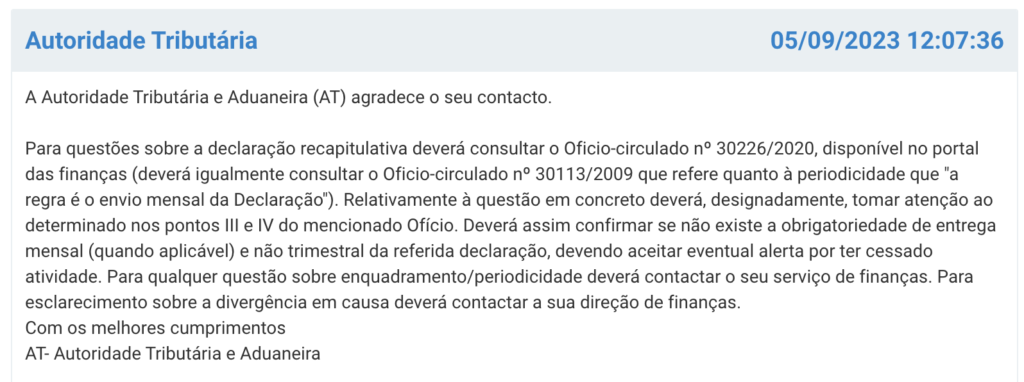

On September 5, 2023, a reply arrives saying that they are not going to modify anything and basically, not to bother anymore.

This meant having to pay an atrocity of VAT (around 10,000 euros) due to the incompetence of Finanças. Diego does not invoice VAT because he provides services to a company outside Portugal.

As we realized that the same incompetent people who respond in e-balcão are the ones who handle the complaints, we started to investigate how we could complain to a higher body.

We sent a “reclamação Graciosa” and a hierarchical appeal, providing all the messages and asking them to listen to the recordings of the calls.

I also filed a complaint with the Municipality of Porto and with the Presidency of the Republic.

They called me from the Municipal Chamber of Porto and told me that they could not do anything and that I should file a contentious-administrative appeal, which was already at a national level and not a regional one.

As the tax return could not be settled either because we would have to pay a fine, we also made claims in this respect.

It is outrageous to have to be wasting time and suffering to do things right. At that moment we understood why in Porto people are dedicated to evading taxes and nobody wants to issue an invoice.

In March 2025 we received an email saying that we could now submit the recapitulative VAT statement, even though the company’s VAT was not registered in VIES for that period. Diego logged on to the website and was able to submit the form without any problems. It seemed that 2 years later, they had finally solved the problem.

Another example of the disaster that is Finanças:

“Portugal é dos países que mais favorecem capital e prejudicam salários com impostos”

“Contribuintes duplicam queixas contra o Fisco”

More articles about life in Portugal:

Ok

🙂